I crunch the numbers on many investment properties and as a person of integrity (my opinion anyway 🙂 ) and somebody that is probably too trusting of others, it sickens me how common it is for the seller’s agents to “juice” the income and expense numbers on the investment property to make the returns higher than they actually are. They know what they’re doing and it’s just wrong! Today I received a flyer in the mail from a realtor / broker that includes his official proforma income and expense summary along with financing and expected returns.

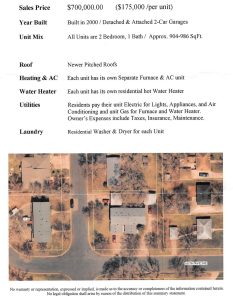

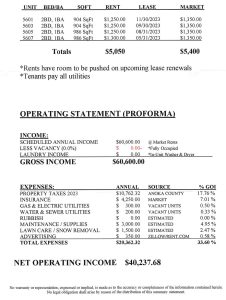

Pretty much every number on here is juiced except the taxes which you can look up publicly.

Income

Current rents are $1,250 per month, while market rents are stated as $1,350 per month, so the rest of the calculations use the higher of the two numbers of course. Note, the tenants pay all utilities here, which effectively reduces the amount of rent they’re willing to pay. I own a four-plex much like this one down the street and they rent for $1,250/mo and my tenants do not pay for gas, trash, water and sewer utilities. The income numbers are wrong anyway as $1350/mo each unit would be $64.8K per year in income and not the $60.6K they used. Originally they probably included some vacancy and later made it 0%.

Expenses

All expense numbers except taxes and insurance are too low.

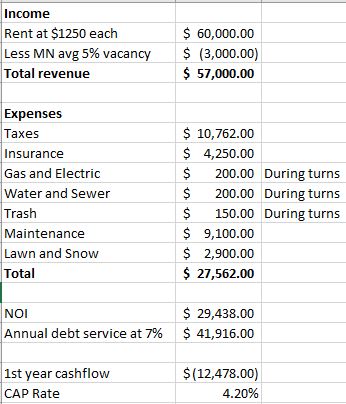

Run your own numbers!

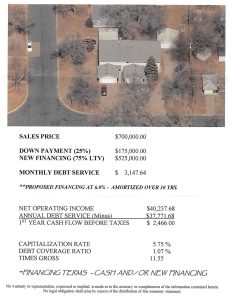

I ran my own numbers on this property to the right using my own experience as an investor and came up with a much different picture. A 4.2% CAP rate instead of the 5.75% this sellers agent was advertising. Seller’s agent presented us with a $2,466 positive cashflow to consider, but then the caveat – “before taxes”. Who ever looks at cashflow without considering the unavoidable taxes!? It just adds to the deceptiveness. The numbers I ran show a $12,478 loss in the first year, assuming normal maintenance needs. If we want to buy this property and realize a 5.75% CAP rate, the sale price must be $512,000 (NOI / CAP rate) and not the $700,000 they’re asking.

Get experienced help analyzing investment properties

I see deceptiveness like this all too often, and they’re measures the seller’s agent is taking to maximize their sales and commissions. Always consider the source and their motivation. If you’re looking at investment properties to purchase and are not comfortable crunching numbers as I did above, then I recommend you get some experienced advice to review the investment opportunities with you to avoid a costly mistake.