What's Happening Now in 2024

As an owner and manager of 55 rental units in Minnesota, I do my best to stay on top of market trends and predictions to mitigate risk and to take advantage of upcoming opportunities. There are many moving parts to supply and demand and income and expenses to consider when making a prediction. So let’s start with what we know and what I’m seeing and experiencing in 2024.

Rent increases were minimal from 2023 to 2024

Our portfolio saw a 0.8% increase in rents in the last year. Some homes saw an increase in rents while others we had to drop the rent to find a tenant.

Rents are very local and it even depends on the style of house as single family rentals have better rent increases than apartments currently. Half or more of our portfolio is single family and the rest is duplexes and fourplexes.

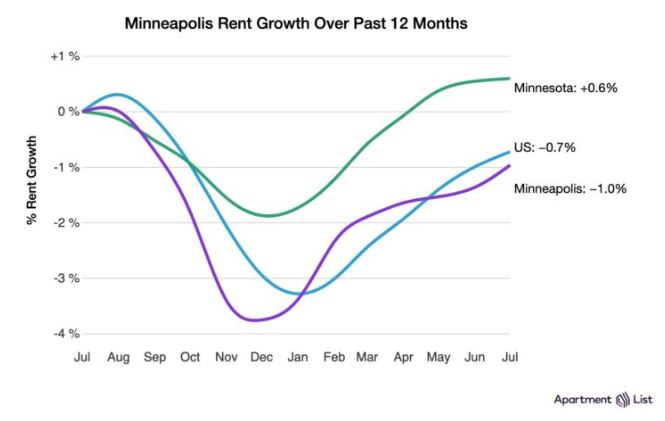

There is a lot of confusion on how the market is doing as various articles will say drastically different things, such as in “MN rents decreased by 1%” while Rentometer.com says the Minneapolis area’s rents increased 6% and St. Paul, the city right next to it, increased 13%. I find it hard to believe rents in these rent controlled cities, which cap the increase of rent to 3% per year, increased as much as 13%.

The Minnesota market is one of the more stable markets in the country. High demand areas of 2022 like Florida and Texas are now the worst markets in the country as home prices have decreased the most (25% or more). Austin Texas saw a year-over-year rent drop of 9.5 percent while San Antonio, Texas, and Nashville, Tennessee, also saw significant rent price decreases of 8.2 percent and 8.1 percent.

Expenses increased dramatically in 2023 and 2024

Handyman labor cost double in recent years; it’s no longer $40 – $50 an hour, it’s ~$100/hr for the first hour and then $65 – $85/hr after that for most capable handymen. It’s such an issue that South Park made an episode about how Handymen’s rates have become so high they’re now millionaires. This has opened the door for more craigslist handymen doing sub par work at $50/hr as this is what we’re used to paying.

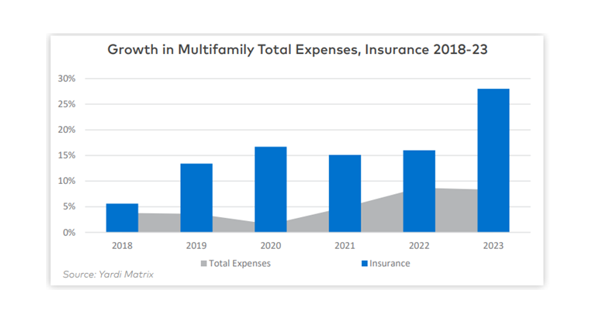

Homeowners insurance policy premiums increased 21% from 2022 to 2023 according to Policy Genius , and this is exactly what our portfolio experienced.

Utility costs are up in the last year – electric +8.92%, gas +6.5%, and +15% for water and sewer (Rogers MN).

Property taxes naturally increased too and it highly depends on your locale. Minnesota’s preliminary property tax increase for 2024 is +7.3%. See my article where I appealed a property tax increase of 30% one one property last year.

Cash flow is down in 2024 and will continue to fall

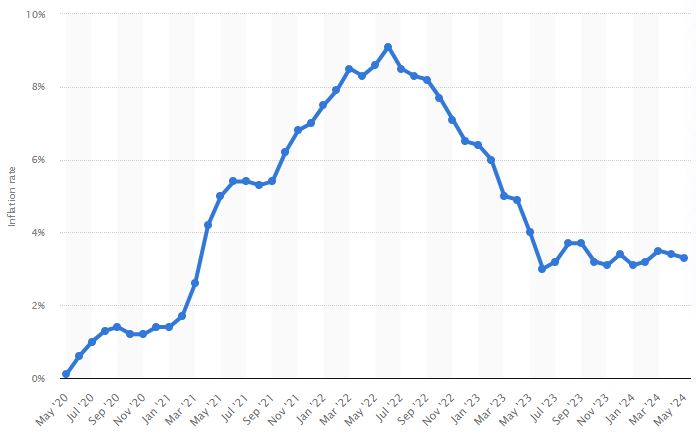

Inflation cooled to 3.5% and is holding steady

The federal reserve was successful in slowing our economy and bringing down inflation by rapidly increasing short term borrowing rates in 2022 and 2023. While they’re under a lot of pressure to perform a rate cut as of mid 2024, even a small one, they have not done so yet as inflation has not reached their target of 2%. European countries recently revised their targets to be 3.5% instead of 2% and then did a rate cut in hopes it would jumpstart the economy again.

Inflation holding steady at 3.5% means the cost increases of goods will continue to be more elevated than we’ve seen in decades. If the fed makes a rate cut, that’ll fuel inflation to go even higher, so it’s likely here for a while.

Prediction of what is to come in 2025 and 2026

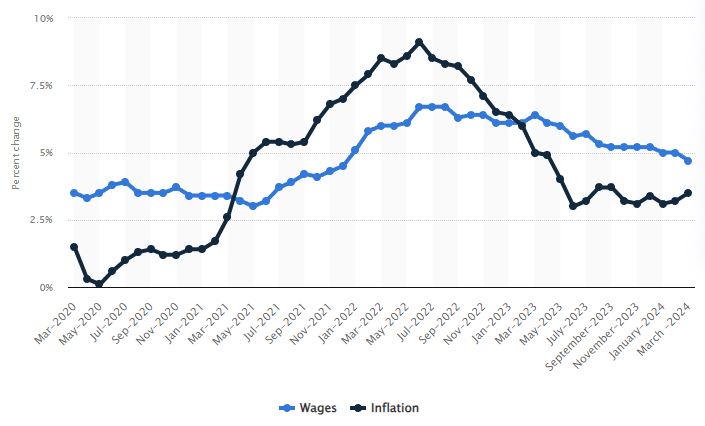

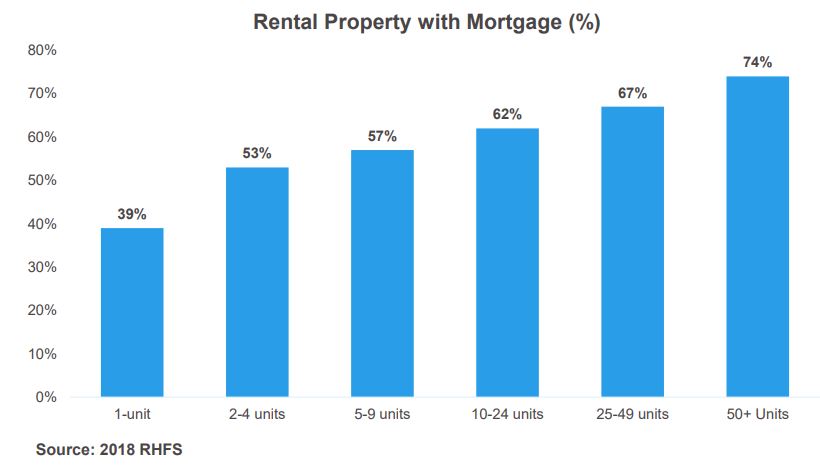

Our country is still in an affordability crisis. Wage increases are outpacing inflation slightly, which is great and much needed, but housing costs specifically are consuming too much of the median family income at 30 – 38% (25% is more normal). With new interest rates factored in, the total cost of ownership has risen nearly 64% from 2020 to 2024. The full effect of this hasn’t hit most rental property owners yet because their mortgage rate is fixed at 3.xx% until adjustment in 2026/2027, and that’s when rental property owners will feel the full burden of the 64% (!!!) expenses increase. Cashflow from rental property portfolios having adjustable rate mortgages (multi-family) will see a 40-70% decrease depending on financing terms. The 10K per month in cashflow you may today have will be 3-6K in 2027 unless rates come back down to sub 5%.

Rental demand and rent price growth will remain low

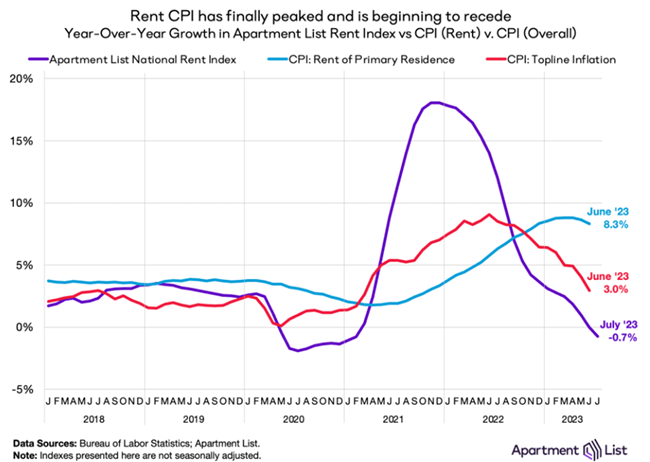

It’s going to take a number of years for household incomes to increase to allow for additional discretionary spending and spending on housing (rent). People want their freedom and independence, and as soon as they can afford to move out of their current overcrowded situation into a rental of their own, they will. The surge in rental prices in 2021 to 2022 has caused lull to occur afterward as affordability comes back into balance. From their research, US News predicts single family rents will increase only 10.9% from 2022 to 2028, and multi-family 7.1%. That’s an average of 1.8% per year for single family rentals and 1.2% for multi-family. While apartments are in over supply, “single family rentals are in the short term better positioned because we’ve actually seen erosion of single family rental supply in most markets” all the while returns are diminishing.

It used to be that two people would rent a home together and split the rent payment. In 2020 – 2022 that became 3 people with the surge in rents, and now in 2023 and 2024 I’m seeing 4 people apply together for the same 3bd home. In addition to this, more people are living with friends and family (mom and dad) as rents are unaffordable. As mentioned above, it’s simply going to take time (years) for wages to increase to the point people can afford more freedom and their own place again.

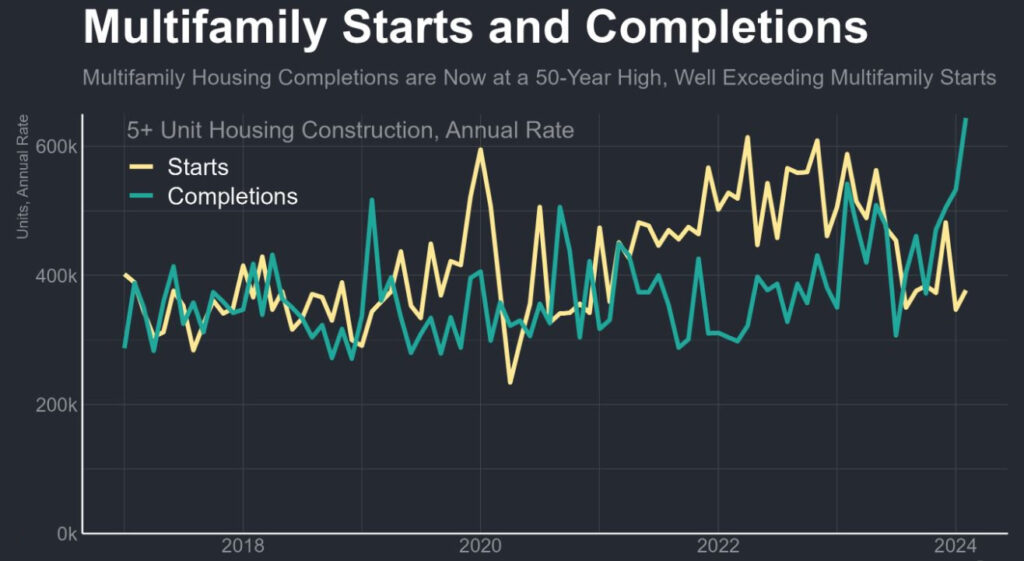

The second factor that’s causing rent growth to be flat or minimal is an over supply of luxury apartments being completed and hitting the market all at once in 2024 and 2025. There is a major over supply in Texas already for example, which caused rents to have fallen sharply. These projects were started when interest rates were low and starting and completing the project made sense. These two factors (affordability and over supply) are what cooled rental demand and rent price growth in the last two years, and in the next two as well.

It’s worth noting that apartment units are in oversupply, and they’re all luxury and at the top of the market for rent ($3,000 or more in Minnesota), they will see the largest rent price drops and are commonly already offering two months of free rent with a signed lease. This will cause moderately priced rental apartments to reduce rental rates accordingly to attract tenants when the luxury apartments reduce their rates. Single family rentals will fare better during this time and should still see 1% rent increases as they will not be in oversupply.

More pain for real estate investors

When inflation is at 3.5% for an extended period of time and for the foreseeable future, and many experts say the real inflation is much higher (why do expenses increase 20-25% when inflation peaked at 9.1%??), and rent growth is 1% at best or negative in some parts of the country, cash flows will suffer more.

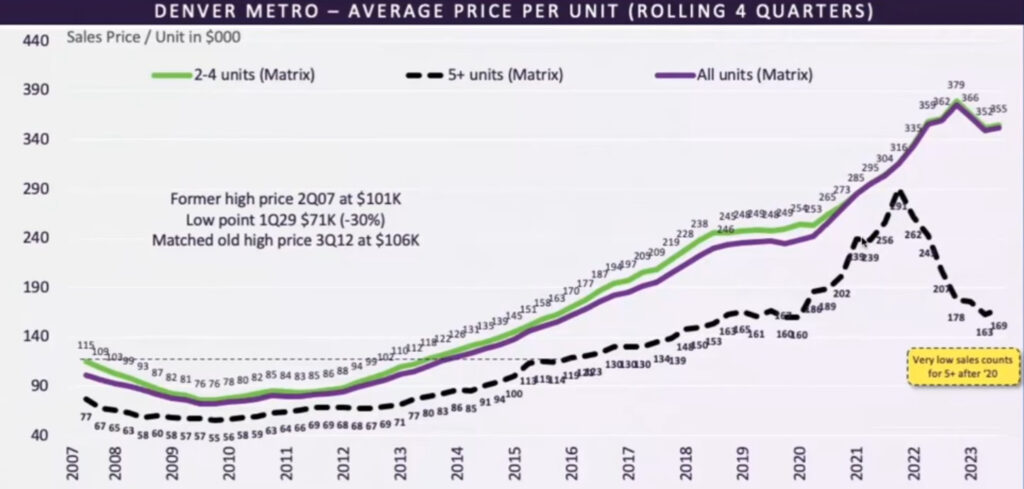

Cap rates have increased approximately 100 bps, from 3.3% to 3.5% to 4.25% to 4.5% and will move closer to 5% in the near-term. Apartments and multi family properties have already dropped in value 25% in the last year (duplexes that used to be 600K are now listed for 450K) as their value is determined by the income they produce. When interest rates increase as they did, the income they produce diminishes, so investors are willing to pay less (25% less) for them. These real losses have already occurred – investors that bought multi-family properties in 2021 and 2022 have completely lost their 25% down payment. It’ll take many years and/or much lower interest rates to regain those losses.

We may see a fire sale on apartment buildings

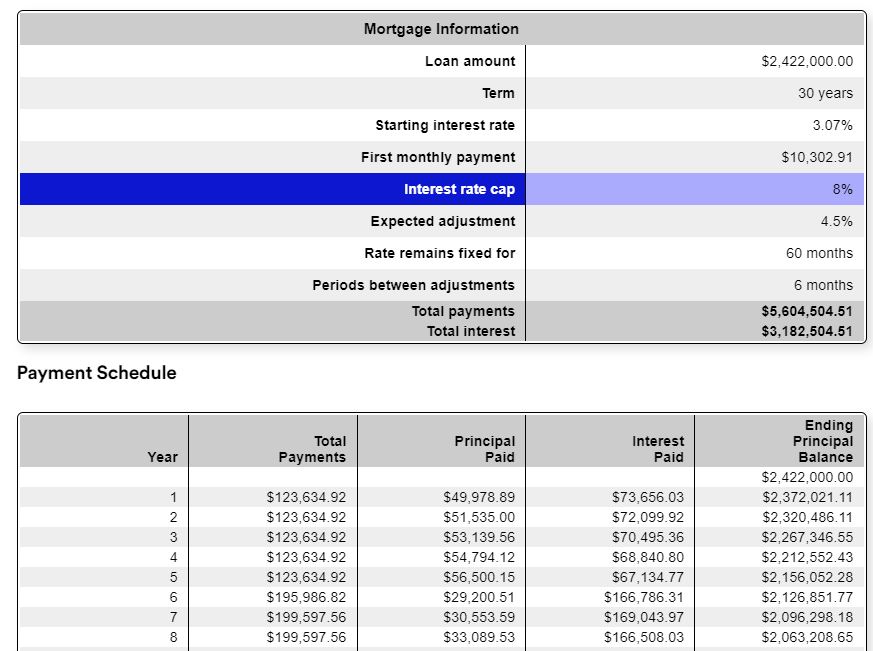

Almost the entire country refinanced their mortgages in 2021 and early 2022. I’ve been analyzing apartment buildings for sale recently and multiple have an assumable loan available currently around 3% interest and is set to adjust in 2026/2027 up to market rate of likely 7-8% when there is no adjustment cap (some loans will adjust a max of 1-2% depending on terms). This adjustment from 3% to 8% will increase the loan payment by 50% and will crush the investment into negative cash flow territory!

The image to the right is an actual assumable loan offered on an actual apartment building for sale. As you can see the annual mortgage payments will increase from 123K per year to 199K per year assuming it adjusts to 8% (this loan doesn’t have an adjustment cap). Not only is financing of apartments going through the roof, but rents will have decreased in 2025 and 2026 due to the oversupply. I’m predicting an increase in foreclosures and fire sales (good deals) of buildings 5+ units in the next couple of years.

When will rents increase?

Because building costs have increased so much in the last couple years, construction starts of new apartment buildings is at the lowest level in decades. This means just after the apartment oversupply of 2024 and 2025 is absorbed into the market, a shortage will occur again in 2026. Grant Cardone predicts rents will explode in 2026 due to this, while multiple other experts say rents will have an increase of 5-6% and then will return to a more normal market of 3-4% increases in the years following. Interest rates will hopefully settle around 6% and wages will have increased by 2028 to make for a more normal market. Keep in mind further out you predict the more inaccurate it becomes, and the predictions tend to become more similar to historical averages.

In the next few years in the more stable Midwest markets we’re looking at rent increases of 1% in 2024, 1% in 2025, and 6% in 2026. That’s +8% rents in the next 3 years (2024-2027), and more optimistically this source predicts single family rents to increase by 15% and apartments +10.9% by 2029 as we’ll see more normal rent growth in 2027-2029.

As rental property investors, we can only hope Grant Cardone is right, while keeping in mind he seems to frequently take extreme positions likely to strike fear and gain popularity. My hope is wages for tenants will increase dramatically to allow rents to also increase dramatically (20% or more) which will mitigate risks of real estate investments going into foreclosure and causing tenants to lose their homes. Given the poor performance of rental home investments in the coming few years, many will be put up for sale and prices may drop even more. Single family homes currently used as rentals will be sold (they already are according to this podcast) to owner occupied owners, which will help ease the home supply shortage for buyers, will put downward pressure on home values, and upward pressure on rents as fewer single family rentals will be available. Of course the hope for increased wages and rents will fuel inflation higher, which means another increase in expenses. It’s all about balance and it’ll come given enough time.

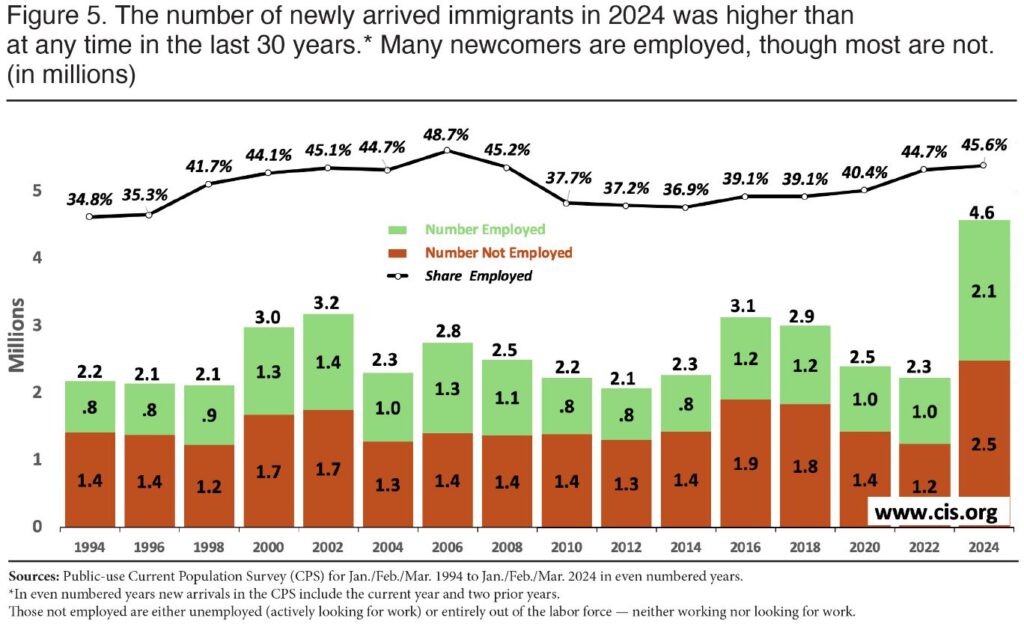

The wildcard - immigration

Immigration into the US increased dramatically in the last few years and continues as if this writing. These people need housing one way or another – provided by the government, rental properties, or home purchases. According to this article, most of them are not working, which means if they can afford rent it would be government funds from a section 8 program or similar. There is already a long waiting list for section 8 vouchers and housing, so an expansion is be needed. This will increase demand for rental properties and will push rents higher, assuming the government doesn’t implement rent control. Immigration is a wildcard on rents because we don’t have a good grasp on how much immigration is occurring, what the rates of immigration will be after the next presidential election, and how (or who) their rents will be be paid for. The quick solution to house the immigrants has been for cities to house them in hotels. Over time I feel the immigrants will be integrated into the US and will have paying jobs and will pay rent on their own, increasing demand and competition for housing, and uplifting rents.

What should investors do today?

I recommend you review your portfolios and identify the worst performing properties. They will not perform better due to natural market forces for the next two years. If these properties have an adjustable rate mortgage, review the terms of the adjustment that’s coming, and calculate your 2026 – 2028 returns on these properties. It’s very possible you’ll come to the conclusion that selling these marginally performing properties and putting your equity into a different investment for a while is the way to go. You might sell these properties today in 2024, and wait to buy apartments buildings in 2026 – 2028 at a nice discount. As you can see to the right, in some markets the apartment value collapse has already started. I’d be happy to run the numbers with you, and if you’re in Minnesota, as a licensed real estate agent I can help you sell and find a better investment that meets your goals.