This is the question we’re all thinking – “How many rental properties do I need to be able to retire early”, or more specifically become financially free. Having control of your time is the greatest thing money can buy, and that requires financial freedom. I created a formula where if you invest $X dollars per year, you’ll be financially free after X years, and we can look at this together and use it, but in the end it won’t be very accurate because life and market variables are always changing and the time horizon to achieve financial freedom is to long (5 – 20 years).

Life And Markets Are Constantly Changing

When I started investing our expenses and lifestyle was lower, so I figured 18 rental units producing $6,000/mo in cashflow was how many rental properties were needed to retire early and be financially free. However as time went on, market dynamics changed and our lifestyle inflated, so the goalpost moved out further and further. The original goal was 18 units, then 22, 26, and then 30. After 9 years we had 38 units and both my wife and I were still working hard and investing as much as we could. Why? Most of the reason for us still working is that our lifestyle (monthly spending) grew by way of moving to a larger house, getting a new vehicle, and starting to travel a few times per year, which adds up quick. This wasn’t by accident; these are choices we intentionally made. We decided we’d rather have some nice things and go on trips and still work instead of attempting to retire in our early 30’s and scrape by for the rest of our lives like what is glamored in the FIRE movement where people retire early to live on $3-5K/mo, only to later become dissatisfied and go back to work. Sorry, but for me that’s not having the “time of your life”, and most people that do FIRE and live in 3K/mo end up going back to work.

Why Is Financial Freedom Difficult to Predict?

Is any investment 100% predictable? I suppose maybe a savings account, but putting money there is actually a losing proposition when inflation is considered.

Sure, we can create a line chart showing if you invest X cash per year into property, you’ll reach your monthly income in X years and then you can retire early on your rental properties. It’s good to have goals and a guide right? The trouble is, there are too many somewhat unpredictable variables that influence goal completion date:

- How much cash you can invest each year.

- How well you use your portfolio’s equity to reinvest.

- Market returns this year and every year after.

- Mortgage interest rates.

- Mortgage payment on each property.

- How leveraged your properties are.

- Average amount of rent per unit as $2,800/mo per unit is very different than $1,400/mo.

- Condition of the properties you purchase and maintenance costs.

- If you self manage or hire a property manager.

- Availability of good properties to purchase.

- Lending standards and requirements.

- Inflation and the cost of living.

- How long can you live below your means?

- Lifestyle and spend once you’re financially free.

Real estate pays you four different ways, but in the end to be financially free, what matters is cashflow as that’s what you’ll pay your bills with. At some point I’ll write another article about how to maximize cashflow from your investment properties. Generally the more leveraged your portfolio is (with loans) the less cashflow it’ll produce, while at the same time it produces the best returns for your wealth ( see my article that explains return on equity ). Another article – The fastest way to being financially free is first focusing on building wealth and then optimizing for cashflow later.

Our Journey

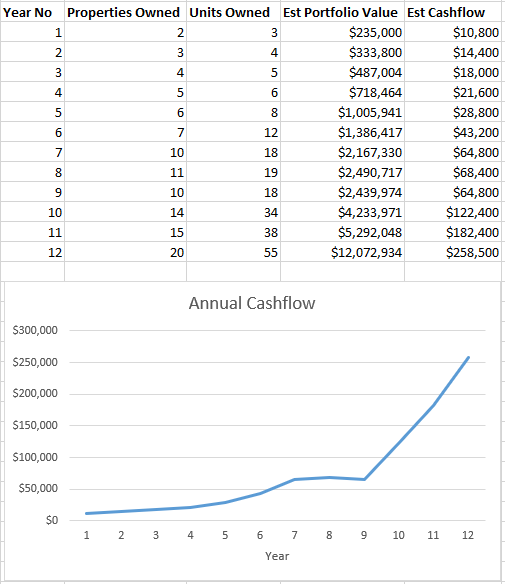

Below is our 12 year journey from owning zero rental units to 55. Check out our full story here. Some life and market changes that happened along the way:

- Second child was born.

- Moved to a larger house.

- Purchased larger and more costly vehicles for growing family.

- Multiple job changes, some of which were unexpected job losses.

- Withdrew 401K and bought real estate with it.

- Interest rates went down and we refinanced most of our portfolio.

- Sold one of our houses and bought a company.

- Sold a company.

- Housing and rental market was consistently strong for a decade

- Worldwide pandemic.

- Inflation was low for many years, then turned very high very quickly, which drove up housing prices and rents.

When To Quit Your Day Job

As you can see from the charts, portfolio value and cashflow will form some sort of upward arc. The first few years are slower and once you’re around 10 rental units things really start accelerating. The right time to exit your day job and retiring early on your rental properties is when your portfolio’s cashflow supports your lifestyle and continues to grow without requiring additional cash investment.

It’s Like Pushing a Snowball

Building a snowman is similar to growing your real estate portfolio in that over time it grows exponentially. This is my daughter and I rolling the bottom snowball of the snowman. There will be challenging situations along your journey, and don’t worry, if you hire me as your real estate investment advisor I’ll be there to help you push through.

Rental Properties vs Stocks

This topic requires a longer discussion, but in short – 9 out of 10 financial related articles about retirement will say something about the 4% rule and the stock market. It would say something like this “If you want to live on $250,000 per year in retirement while maintaining the purchasing power of your portfolio, you can withdraw up to 4% per year and you need 6.25 million dollars in your stock / 401K / IRA / retirement account”.

With real estate it’s not too difficult to get a cash on cash return of 8-12%, so let’s use 10% in this example. To have $250,000 per year in retirement, you need a cash investment of only 2.5 million dollars instead of the 6.25 million as with stocks!

OK, but really, how many rental properties do I need to retire early?

Considering all the variables and life changes we don’t even know about in the coming years, sure we can create a model and plan to strive towards, knowing it won’t be very accurate. Looking at my journey above, after 9 years we had 18 units that provided a mostly tax-free 65K per year. During this time my wife and I were employed full time and I did side work and we were able to invest $30,000 to $40,000 per year ($50,000 per year in todays dollars). I think this is a good and reasonable expectation for most people. When you hire me as your real estate investment advisor, I’ll create a custom plan for you based on your goals and time horizon. At first all you have is cash to invest to get things rolling, and this is when it’s most difficult and the returns are lowest. After a few years you’ll have equity available to use for purchases and over time the cash you invest in will become less significant as the portfolio starts building itself.

In year 9 I bought a business and worked my tail off, maintained our lifestyle, then sold it and put all I could into more rental property. I encourage you to own a business and I’d be happy to advise you on small business ownership as well.