Have you ever considered purchasing property in a different state? Chances are your local market is not one of the best real estate investment cities for 2023 for maximum returns. I live in the Minneapolis Minnesota area and I can tell you it’s definitely not the best market for real estate investing for a number of reasons. Today it’s much easier to invest remotely with all the data available to us, as compared to when I started investing in real estate. If I were to start over with real estate investing today, I’d be looking at these markets instead of anything within 30 minutes of my house.

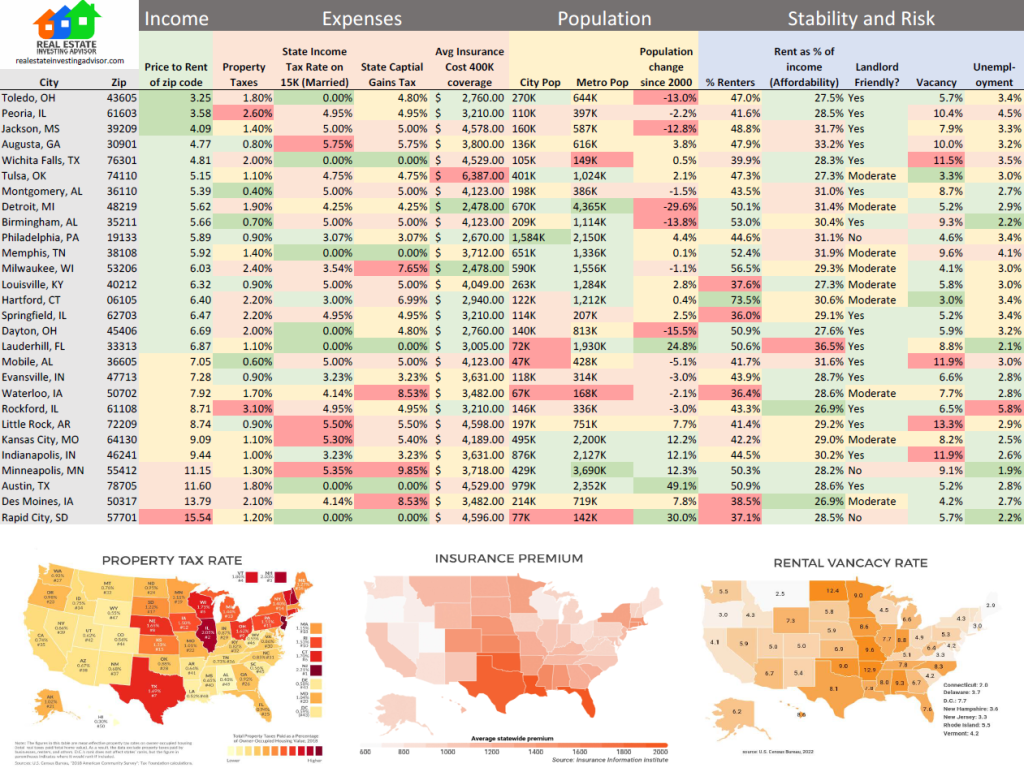

There is a lot to consider when thinking about purchasing rental property in a different state beyond cashflow like property taxes, cost of insurance, health of the local market like vacancy and unemployment, and if anybody will still live there in thirty years. With a few days effort, I put together the below market Analysis. Click the image for a larger full view or download as a PDF here.

Below are the factors are considered to make the list of the best real estate investment cities. We’re looking for maximum and consistent with minimal risk. Factors such as price to rent ratio followed by property taxes, insurance premium, and vacancy will have the greatest impact on cashflow.

Price to Rent Ratio

This is the best metric to quickly identify markets that may be good for investment. Zip code 43605 in Toledo OH for example is where you can find a home for 125,000 that produces $38,462 in annual rental income. In the Minneapolis area we’d need to spend $428,846 to obtain the same amount of revenue!

Property Tax

Comes right off your bottom line so we want this as low as possible.

State Income Tax

If you have a few rental properties in another state, you might show a little profit and owe some tax. The analysis and rates above assume $15,000 of taxable income from the state. In most cases, you’ll receive a credit in your home state for any taxes paid to the state where your investment is located, but keep in mind your local state will charge you their full income tax rate. If you live in Minnesota like I do where the state income tax rate is 5.35% for 100K of income, and I have real estate investments located in a lower income tax state, this makes no difference to me as I’m still going to pay Minnesota their 5.35% state taxes on the full amount of income earned in the other state. It matters when you live in a state with low income taxes like Texas and your investment is in a higher tax state as you’ll be paying more income taxes on the rental income that you otherwise wouldn’t pay if the rental investment was located in your state of residence.

Capital Gains State Tax

Similar to paying state income taxes, you first owe capital gains taxes to the state where the sold property is located. Then you’ll receive a credit in your home state for capital gains taxes paid to the other state, down to $0. You won’t get a refund if negative and will pay more capital gains if the state of investment has a higher rate than the state you reside in. Do a 1031 exchange to avoid paying capital gains taxes, or use the property as a primary residence in 2 of the last 5 years to reduce or avoid the liability.

Property Insurance Cost

Right off the bottom line so you want to minimize this expense. States with more weather related issues generally have higher rates.

City and Metro Population

Real estate investments in less populated areas tend to have higher vacancy rates as it generally takes longer to find a new tenant during a turnover.

Population Change

Indicator of future vacancy and rental demand. This should be considered along with the number of building permits (new construction) in the area. Toledo OH for example has a negative outflow of people, and very few new construction permit applications. A red flag would be if there was a moderate or high number new construction permits issued in a city with a negative migration of people.

Percentage of the Population That Rents

Size of your customer base / renter pool and the more the merrier. College towns will have a large renter pool, but keep a close eye on the college “physically in class” enrollment as a failing / declining college enrollment will create more vacancy and downward pressure on rents. This is happening in a smaller town where I live and there are many multi-family apartments for sale that are 30-40% vacant.

Landlord Friendly vs Tenant Friendly States

This has a direct impact on your ability to get rid of bad tenants. In tenant friendly states, it can be near impossible to get rid of a bad tenant, even after you win an eviction hearing that takes months (it happened to me here in MN). Tenants in these states will also have more rights to withhold rent until their opinion of a maintenance issue is resolved to their satisfaction.

Rental Vacancy

The vacancy numbers in the chart are for Q3 of 2022, and vacancy fluctuates more than you might expect. Minneapolis was around 6% for Q2 and jumped to 9% in one quarter. This is good to consider as higher vacancy causes downward pressure on rents, so not only will your homes be empty longer, but they’ll rent for a lower dollar amount. Tip: vacancy is higher and rents are lower in the winter months, so I recommend having all leases expire Apr – Sept to maximize rent and minimize vacancy.

Unemployment

While not the most of important factors to consider, it’s good to keep an eye on. In the event your existing tenant loses their job, how quickly they’re able to find a new job to keep rent coming in? The higher the unemployment, the fewer jobs and more competition they have in the job market.

Other Considerations

Real Estate is Local

This chart was created as a starting point to find general locations of the best performing real estate investments. As you know real estate is very local, and valuable neighborhood by neighborhood information that you won’t necessarily find on the internet can be sourced from locals. You know this information about your hometown, such as crime rate, general quality and condition of the homes, large employers in the area and how they’re performing, if certain areas have high crime or drug issues, or people are migrating away. I recommend having a conversation an experienced local realtor about the area your potential investments homes are located in for more insight.

Rent Control

As of this writing 6 states, or cities within the state, have rent control including California, New York, New Jersey, Maryland, Oregon, and Minnesota. Generally these states aren’t good for investment to begin with, but an eye should be kept on this. St Paul and Minneapolis MN quickly passed a rent control measure in 2021 capping rent increases at 3% seemingly without much thought as to the consequences. Investors are losing their shirts as the 3% increase they’re allowed isn’t even close to keeping up with 8-9% inflation, a surge in multi family homes are for sale at discounted prices, and new construction of housing units, which would increase the much needed supply of housing, has halted. I recommend avoiding areas with rent control at all costs. It’s an important check (do a google search) to see if they are seriously considering rent control in a market that you’re considering that doesn’t currently have it. I’d also consider choosing a different market in this case.

Next Steps

Now to the fun (or the grind) part – start searching for your next gem of a property to purchase. I spent hours analyzing properties in Toledo OH, Peoria IL, Jackson MS, Augusta GA, Wichita Falls TX, Tulsa OK, Montgomery and Birmingham AL, Memphis TN, Philadelphia PA, and Milwaukee WI. I definitely found a few gems, but surprisingly, I didn’t find anything worth buying in most of these areas. While the price to rent ratio is good, high costs of property taxes and/or property insurance, or low quality homes made them unattractive. Schedule a one on one real estate investment advisor call with me and I’ll show you where to find good investment properties.