As a Real Estate Investment Advisor my clients are asking “should I invest in real estate in 2024?”. Let’s take a deeper dive into what the real estate market has done in 2023 already, my predictions for 2024, and what all this means for investing in residential real estate in 2024.

I should preface this that with so many moving parts and risks, predicting the next two years is especially challenging. You’ll find 50% of economists predicting recession and the other 50% predicting growth. Things are changing rapidly, and next quarter the predictions may be slightly different than this writing as we learn more about the direction we’re heading.

Real Estate Market in 2023

Inflation

Inflation has come down dramatically from the 9% range and was down to 3.09%, but just recently went back up to 3.68%, which is the wrong direction. Why did inflation increase so much again to begin with? Mostly because the government ran their money printers on high and spent too much money related to COVID relief and the continued high government spending in 2022 and 2023.

Most articles you read will say inflation is bad for everybody, but I say inflation is really good for real estate investors that have mortgage loans (ideally 30yr fixed) on their properties. The higher prices and wages that follow inflation will make rents increase quickly all the while the mortgage you’re paying on an investment property stays the same, leaving you with higher cashflow.

Inflation fell in 2022 and 2023 because the federal reserve increased the federal funds rates from 0.25% to 5.5% over the last 1.5 years. This increases the cost to borrow and do business on short term loans, which slows the economy, and reduces inflation, as it becomes more difficult for businesses and consumers to make purchases and investments with a reasonable ROI.

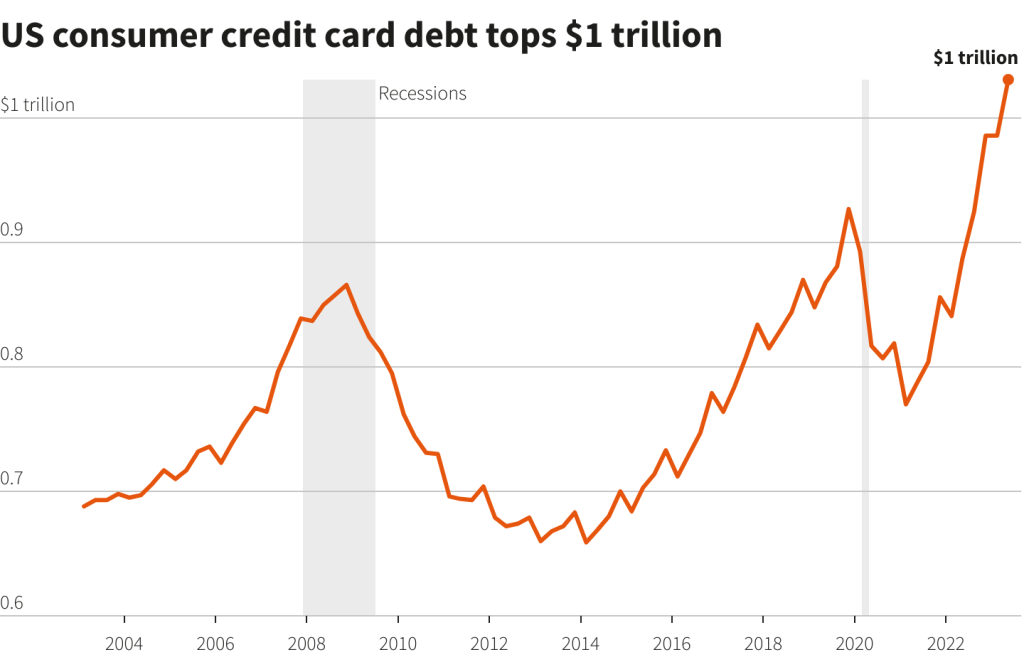

Consumers are taking on more debt

Consumers are trying to maintain their current lifestyle by carrying more credit card debt.

In 2023 I’ve seen more tenants paying rent on a credit card and incurring the 3% transaction fee than ever before.

You may be wondering why credit card debt fell dramatically during COVID and its because people were in lockdown and not out spending money, and the government gave away money to Americans during that time to help them buy essentials, which eventually played a major role in increased inflation.

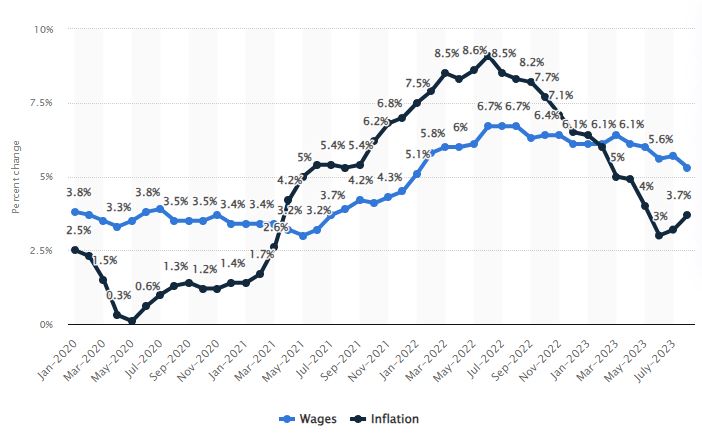

The US is in an affordability crisis

High inflation caused the price of everything to increase rapidly, and wage growth didn’t keep up (it generally lags) so consumers aren’t able to maintain their lifestyle while earning the same or slightly higher incomes. In the last two years prices are up 13% according to the CPI, but in many cases, as I’m sure you’ve experienced, the price of goods and services increased 25-30% in the last two years. Food, automobiles, and travel costs increased much more especially. Just head to Wendy’s for lunch and you’ll find their value meals are 35% higher than they were 3 years ago at $14 today.

Wage increases lag inflation as employers are forced to pay more due to necessity when employees leave for higher paying jobs. Good news – wage growth is higher than inflation in 2023 and is sorely needed, but still rental assistance programs are overwhelmed by people that don’t have enough money left to pay rent.

Mortgage rates are much higher

The slowing of the economy makes investors feel additional risk about the future as stocks will likely struggle, so the safest investment is government bonds and securities, such as the 10 year treasury of which mortgage rates are loosely associated to, because they are considered risk free. When demand for these securities is high, they’ll sell at a premium. Investors consider buying treasuries or mortgage backed securities, and usually need about 1.9% more of a return on mortgage backed securities than the 10 year treasury for the added risk when making a decision on which to buy. Today, the 10 year treasury is at 4.98%, and 30yr interest rate is around 8.5%, so a huge spread of 3.52% between the two. This unusual spread indicates investors are fearful of an upcoming recession, and if those fears subside, we could see rates come back down to the 6.9% range assuming the treasury says at 5%. That is “if”.

The monthly payment on a $300,000 loan at 3% interest rate in 2021 was $1,265/mo. Today at 8.65% the payment is nearly double at $2,339/mo. What do you think that’ll do to housing demand and housing prices? A little secret… it’s not “up”.

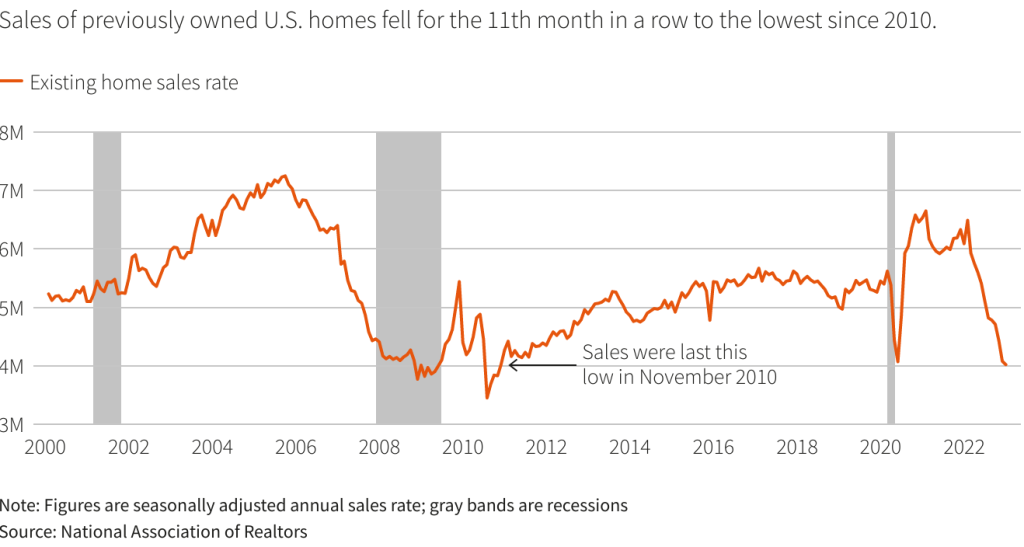

Existing home sales slow dramatically

The effects of higher interest rates and higher mortgage payments as a result are taking its toll as home sales are at its lowest point since the great recession back in 2010.

As of Q4 2023 housing inventory, while still very low, is increasing and more prices are being cut than in previous years. Multiple offers on a house still occur from time to time, but not nearly like it did two years ago. Demand is falling.

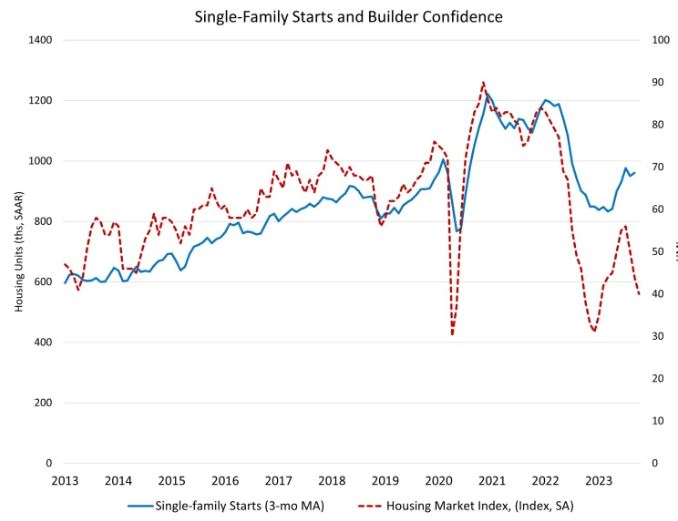

New construction housing slows

Housing starts have declined since inflation and interest rates increased dramatically. More builders are pausing their developments as they’re unable to sell the homes they currently have completed. We’re seeing price drops occur in the completed inventory, and buyers are getting their new homes quicker than planned as buyer cancelations on their new homes have also risen dramatically.

One builder recently came to me asking if I have any handyman work available for this staff of construction workers to stay busy with. As you might expect, layoffs in construction increased in 2023 and likely more to come in 2024.

2023 effects on real estate investors

Higher interest rates and an economic affordability crisis has effects on rental properties.

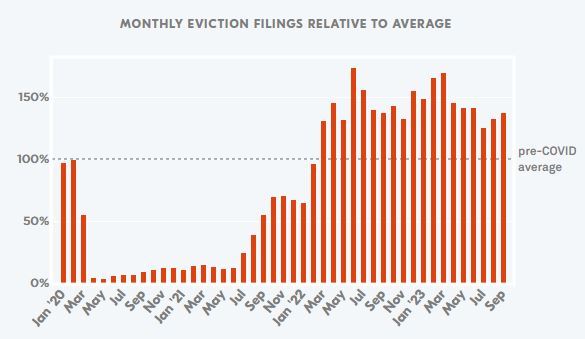

Eviction filings are above average

Evictions are higher in 2023 than pre-pandemic levels, and especially in Minnesota where eviction filings are 43% higher than the pre-covid average according to eviction lab. I’ve personally had a record 4 evictions (from 55 units) this year that cost 8 – 14K each considering the lost rent, legal fees, trash cleanup, and improvements needed to re-lease.

It’s been challenging to find qualified tenants in 2023. On one rental listing I declined 12 applications before finally finding a qualified tenant, and multiple declines on others which isn’t normal.

Rents are declining

Yes, rents are declining nationally at 0.9% according to realtor.com. A small amount, but keep in mind rents declining are not common. Rents are up 1.2% in 2023 in the Minneapolis MN area, and are up/down in various markets.

Wouldn’t you think when the monthly payment required to purchase a house nearly doubles that demand for rental homes would skyrocket? You’d think so but overall rents are down due to inflation and the affordability crisis.

One strategy people are using is to rent with more people per unit to reduce their cost. I recently rented a 3bd home to 4 unmarried young people, and previously I’d see this with just 2-3 people. The $1495 rent will be split up 4 ways. People are moving back home to live with parents at a greater rate also. Both of these reduce demand for rentals.

Rentals on the lower end of the market have high demand while those at the top of the market have much less demand, meaning longer vacancies and reduced rental income. Having rentals below the median rent price in your area is a good investment strategy to minimize vacancy during difficult economic times. I experienced this first hand with homes renting above $2300/mo as they have MUCH less interest than 3bd rentals below $1900/mo.

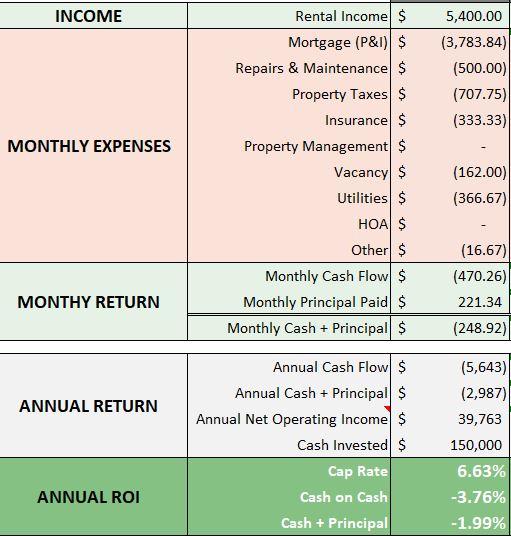

Cashflow is down

High mortgage rates reduce cashflow significantly on new purchases or if you have adjustable rate mortgages ending their term. It’s very difficult to find an investment property that’ll cashflow positive, unless you have a down-payment of 40% or more.

Real estate taxes increased more significantly than usual due to higher property values of 2020/2021, and local governments’ need for more tax revenue as their expenses have increased. This also puts more strain on cashflows from rental properties.

Cost of maintenance is way up due to inflation on both materials and labor. The cheapest electric dryer at Home Depot is now ~$600; it used to be $400 a short time ago. Handyman labor, for a decent handyman, is in the $65-$75 range here in MN. Ten years ago I paid $20-$30/hr. $2,500 to have a plumber install a new water heater in 2023, and heating and air prices have skyrocketed as well.

Not only are mortgage payments and expenses up, but rents are flat in 2023. It’s a challenging time for cashflow.

Investors are feeling pain and will likely cashflow less in 2023/2024 than they did in 2022 as the usual 4% increase in rents were actually round 0% in 2023 while expenses increased significantly.

Purchases are not as attractive

Many real estate investors are on the sidelines as negative cashflow is a tough pill to swallow.

The high interest rates and high prices are a deterrent to performing 1031 exchanges as investors who use mortgages (non cash buyer) are reluctant to give up their 3% rate for an 9.5% (non homestead) rate.

At a 600K purchase price with 25% down and 9.5% rate, this fourplex, which currently has multiple offers, will negative cashflow 12K per year. This is not very attractive at all. For this property to cashflow positive one dollar, a purchase price of $460,290 is needed.

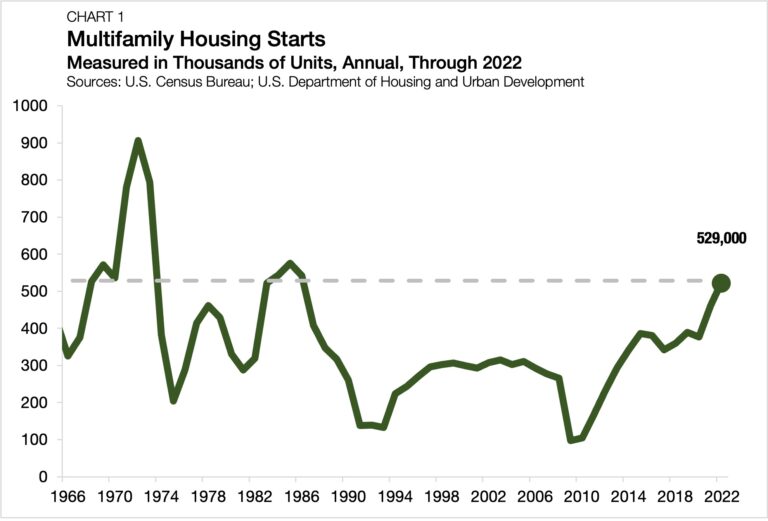

Then why are investors paying this you may be asking. If they have a long time horizon and nowhere else to put their money, then I can see it making sense. There is still huge demand for multi-family and while more of this property type is finally hitting the market, it’s still not nearly enough to meet demand.

Real estate predictions for 2024

As an investor I’m always trying to predict the future to find opportunities and mitigate risk.

Will mortgage rates decline in 2024?

There are many moving parts to this, to an accurate prediction is challenging and nobody knows for sure.

Currently the FED is keeping a close eye on inflation, which is currently at 3.7%. Their target is 2%, and they need to keep increasing short term borrowing rates, which has an indirect effect on mortgage rates, until it gets there, even at the sacrifice of unemployment. Yes, they will put people out of work to bring inflation down, and this usually creates a lot of political pressure upon themselves to reduce rates, which will likely increase inflation. As of Q4 2023 they are considering one more 0.25% rate hike for the December meeting. With economic growth continuing and inflation ticking up again, it’s likely the FED will increase rates again before reducing them.

Economic uncertainty increases mortgage rates and this is seen in the current spread between the 10yr treasury and current mortgage rates as mentioned earlier. There is a lot of fear of recession in the US, and 240,000 tech professionals lost their job due to layoffs so far as of Oct 2023.

So far as of Sept 2023 the US has shipped 75 Billion dollars to Ukraine to aid them in their war. A few weeks ago in October, another war started in Israel and president Biden wants another 105 Billion to send to both countries to assist. Our government’s money printers continue to work overtime, and war in the middle east usually means higher gas prices for the US, which will increase inflation quickly.

If the US avoids a recession and global wars settle, the spread between the 10yr treasury and current rates should go back to a normal around 1.9%, which means 30 year mortgage interest rates of around 6.7%.

I do feel mortgage rates will down a bit in mid to late 2024, but will take a more pessimistic view that they’ll be 7.25 – 7.5% in late 2024 as the number of factors keeping them elevated outnumbers the factors that could bring them down. If we look to 2025, there is a better chance of rates being in the 6.5 to 7% range.

What will happen to housing prices in 2024

So far in 2023 housing prices have been stable due to continued low inventory and sellers commonly taking their home off market or renting it instead of dropping the price. Given that housing starts are down, and sales of existing homes are down, this means housing inventory will remain low, keeping prices generally where they’re at. However, at some point demand wanes, and who knows how much pent up demand there is vs low inventory, but it does seem to be wearing thin. On a positive note, increased wages will allow more people to afford to purchase a home.

I predict housing prices will decline a small amount for the first half of next year, and then increase slightly in the fall as wages have improved by then. Most sources are predicting a 4-5% increase in home values next year, so my prediction is not inline with most opinions.

If mortgage rates do sharply decline like into the low 6’s or even 5’s, which I don’t think will happen, we will see housing prices increase quickly. Again, it all comes back to affordability and lower mortgage rates will allow people to afford to pay more for homes and the bidding wars will return.

What will happen to rents in 2024 and beyond?

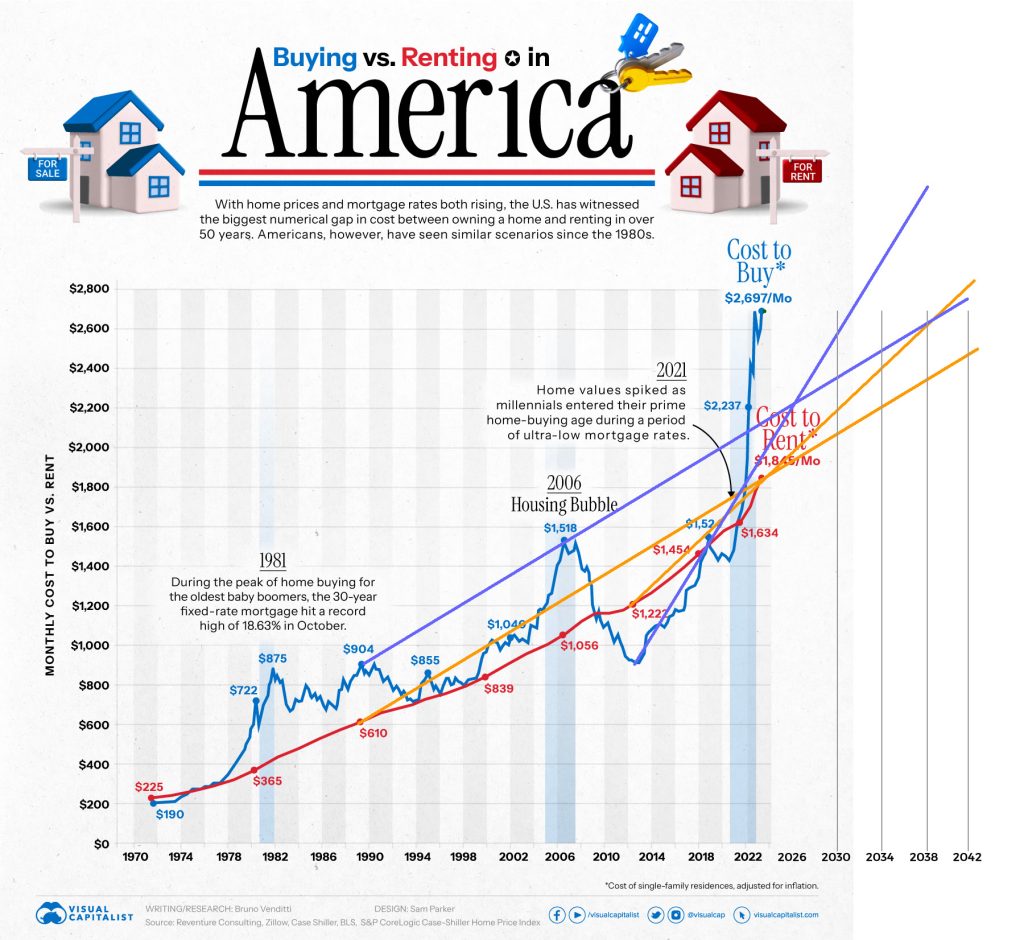

In the image below from visual captalist , you can see the disparity of the cost to buy in monthly payment vs current rents in 2022. A couple observations

- Movement in rents tend to mimic and lag whatever housing prices are doing.

- Rent price changes are much more stable.

- Rents rarely decrease and if they do it’s a small amount for a short time.

At some point in the future the two lines will draw closer and intersect as they historically have. I drew a few moving average lines (purple and orange) and extrapolated for future years. It’s no exact science, but chance are this will be close. One caveat – homes have increased in size more recently, so a moving average line starting from the 1970’s isn’t consistent because we’re not buying the same type of houses that was built decades prior, so a second line starting more recently in 2012 was added to provide a range.

As you can see, it’s likely that the cost to buy a home will likely be flat or fall in the near-term. We can’t build houses any cheaper due to inflation increasing material and labor costs, but what will help the monthly payment is lower mortgage rates (slightly lower 1-2 years from now). The cost to buy will be flat / the same in 2024 because as soon as rates drop a little, it’ll allow people to afford to pay more for houses so the prices will increase accordingly. With my prediction of rates possibly coming down to 7.25 – 7.5% in late 2024, we will see housing prices increase slightly 1-2% at that time.

Should I invest in real estate in 2024?

One advantage I haven’t mentioned is there are more multi-family properties on the market then I’ve seen in at least 5 years. If you’re starting out in real estate and want to buy a fourplex, you finally have a few properties to choose from here in the Minnesota market. They’re priced high, and some are still selling within the first few days on the market for numbers that don’t make sense for most investors, but they’re available.

I’m seeing total returns for the first year of ownership including negative cashflow, mortgage principle reduction, and appreciation in the 10-12% range, while it’s usually in the 25 – 30% range. If your time horizon of ownership is short like 5 years or less, then I’d say “no” and instead wait 1-2 years as I feel home values and rates will fall slightly and rents will have increased. If you do find a great deal where cashflow is near zero (instead of negative) with a CAP rate of 7% or more, then by all means buy it.

For most people including myself that value cashflow above building wealth, it does not make sense to buy in 2024. However if you can handle negative cashflow for a few years and have a long time horizon of 12+ years, it still makes sense to buy real estate to build long term wealth and if you need near-term tax write-offs and not cashflow. I recommend buying units that rent for below the median price in your area as those will be the most stable and have the highest demand during this time. When the rates come down your property value will increase quickly and then you can refinance for the lower rate and have the opportunity for a cash out refinance.

If you your time horizon is long (15+ years) and you have another source of income that provides good cashflow, then it’s a good time to buy real estate and wait. Real estate will still build wealth faster than most other investments such as stocks (10-12% plus tax shelter vs 8% with stocks).