One of my real estate coaching clients recently asked “should I buy a duplex or fourplex” as his first home purchase and real estate investment. He plans to live in one of the units and therefore is able to purchase the building with an FHA loan and only 3.5% down.

The right investment depends on a lot of factors – budget, cashflow, location, local economics and government, interest rates, demographics, etc. The right investment for one person may be different for another. But from a total returns standpoint, not just cashflow, and all else being equal about the investments, you’ll get the greatest returns by using as much of other people’s (banks) money as you can.

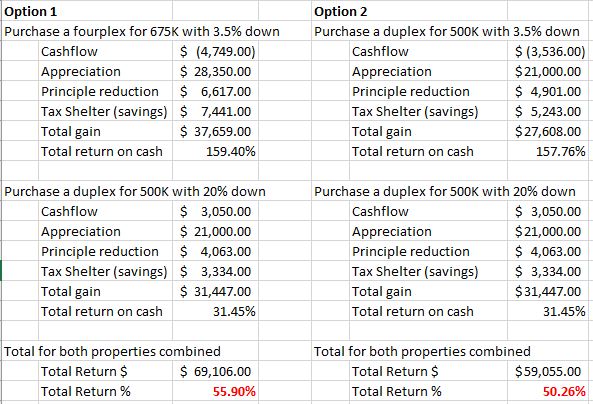

Below is an example of a buyer that has $125,000 of cash to invest into real estate and two potential approaches on how to best invest in real estate.

Option 1: Purchase a four-plex at 3.5% down, and then a duplex at 20% down.

Option 2: Purchase a duplex at 3.5% down, and then another duplex at 20% down.

More details about this setup and comparison:

- Loans are 30yr at 7%

- Buyer has annual income of 100K and pays 22% federal income taxes and 7% state income taxes

- Home appreciation is 4.2% annually and land value for both properties is $100,000.

- These returns are annual for the first year.

- I spared you from the calculations used to generate all the numbers to simplify.

- Both the fourplex and duplex have a 7.0% CAP rate.

You get one FHA loan at most at a time, which provides ability to use as much of other people’s money as possible with only 3.5% down. The best use of your FHA loan is to buy the largest and best performing property you can find, which is at most a 4 unit building.

Note the negative cashflow when putting down only 3.5% of your own money, and with 7% or higher interest rates and PMI, finding something that positively cashflows is nearly impossible (I would say impossible but there is always a chance). You’ll need other supplemental income from your job or other investments to reduce the burden of negative cashflow for the first few years. Sound terrible? Yes from a cashflow standpoint, but where else (investments) do you find total returns of 55% every year to build your wealth?