Every March I receive about 45 pieces of mail related to property tax assessments and for the first time since becoming a real estate investor in 2010 appealed one of them. I’ll tell you about my experience appealing my property tax assessment and provide you with tips and recommendations on appealing your property tax valuation.

My Property Tax Valuation Is Too High

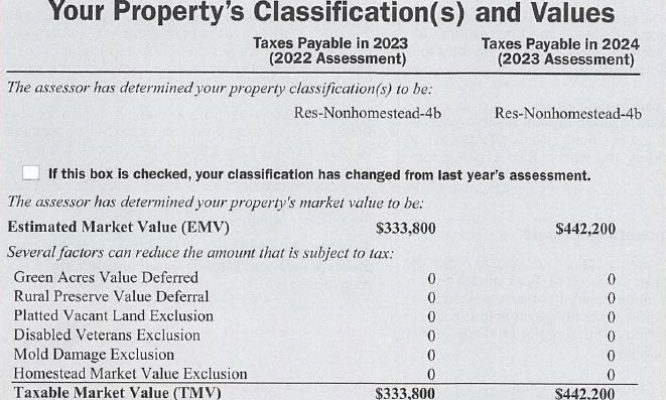

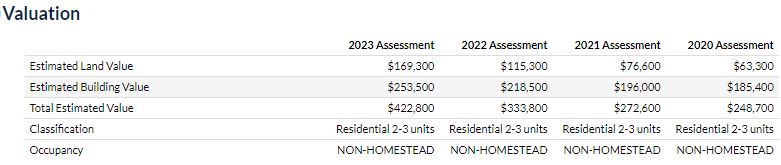

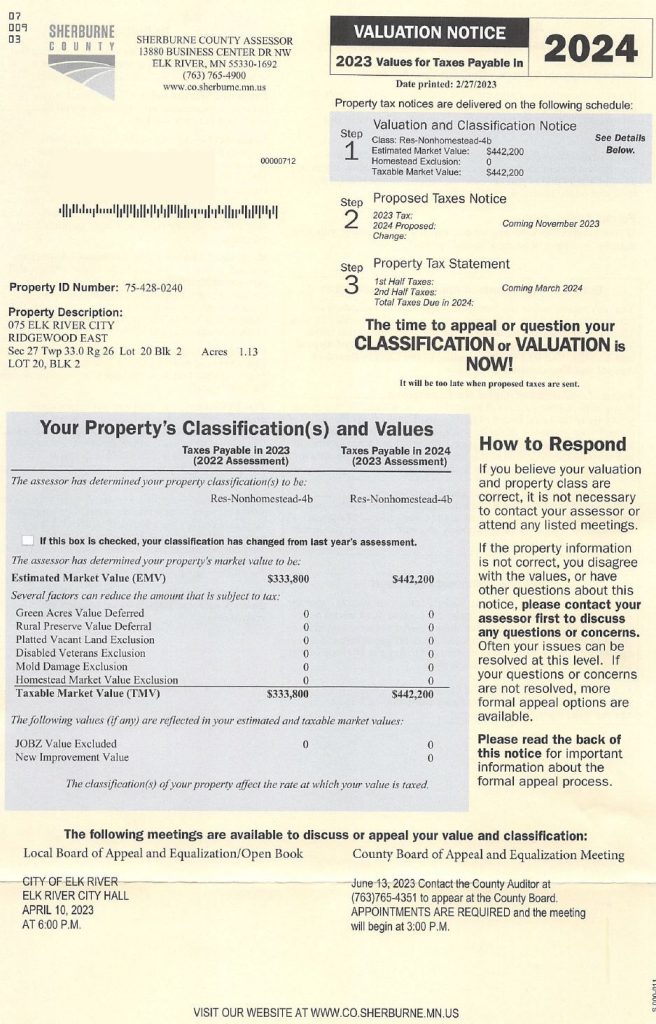

The 2023 assessment as you can see in the article’s featured image shows the $442,200 they originally assessed it at. I was able to grab a screenshot of the annual assessment numbers after the first reduction I received to $422,800 above. So what’s the problem?

- The land has nearly tripled in value in 3 years, up 270%!! There must be gold in the ground!

- The total valuation is way above market value and I couldn’t sell it for what they’re taxing me on. I’m pretty confident our duplex would sell for $350,000 – $365,000, and being originally taxed at $442,200 would cost us an additional $600 per year in unnecessary taxes.

How the Assessor Values Property

The county assesses a value on your property for the purposes of taxation to pay for public works, public safety, and other local expenses.

Would you believe the county assessor sets a market value in a different way than a private appraiser does? A private appraiser looks at your property in many ways and compares it to nearby home sales and considers the details of the features and finishes of the property to generate their appraised market value of what the home would sell for.

The county assessor will also consider local comparable sales, features of the home, and often times they just have a computer program generate a number based on a blanket target increase for the county. After all, they have thousands of homes to assess a value upon.

In my case, the assessor’s initial reasoning for the valuation is that he couldn’t find another duplex comparable sale, so he found recent sales of twin homes and just doubled their value to arrive at mine. What crazyness is this!? An average twin home sells for below the median sales price in the area, so many homeowners want it because its affordable and they’ll bid up the price. A duplex is purchase by investors based on the returns it’ll produce, so just wow this is so wrong.

Keep in mind the time period the assessor is looking at. Their assessment is not current value today; it’s the value of 12-16 months ago, and this value is used for taxes the year after the current year.

How to Appeal Your Property Tax Assessment

The property tax valuation notice will include instructions on how you can appeal. Counties have differing processes for this.

First Do Your Research

First research and build your case to support what you feel your property is worth and why. Having comparable sales of similar properties is essential. I also recommend you check the county website for those similar properties and compare your tax assessment to theirs. Consider the amount of land each of your properties has and its assessed value in addition to the home. Just calling the assessor and complaining will get you nowhere.

Contact The Assessor

Once you have your case prepared, contact the assessor directly. Don’t just show up at the council meeting without having done this first as it’ll just be time wasted and they’ll tell you to just meet with the assessor. The assessor is interested in working with you to resolve the discrepancy as they’d rather the issue not go before the city council. Explain your case to the assessor and again, use concrete evidence and facts instead of just giving them a hard time about the valuation. The assessor will ask if they can come view the property and it’s possible they’ll come up with a slightly different valuation, and know that it could end up being even higher so be aware of that risk.

The assessor did view my property and called me back with a valuation of $422,800, which was down from $442,200 because they were not aware the basements in my duplex were unfinished. I let the assessor know that was appreciated, but we’re still way off from the $350 – $365K I felt the property was worth and I’d see him at the city council meeting.

Appeal at the City Council Meeting

Likely the next step in your appeals process is to plead your case to the city council and assessors. You can do this on your own if you feel comfortable. The room may be crowded and it’ll be televised and recorded. Or you may consider hiring a company to represent you and pay them a fee. In my experience I didn’t see this occur and people represented themselves. Very few people take the time to do this; less than 1% of people appeal their valuation, and far less go to the council meeting.

At the council meeting and after saying the pledge of allegiance (I haven’t done that since second grade), present your facts to the council. They have ability to discuss and consider your case outside of the tools and measures the assessor used for your valuation. Keep in mind they are not professional appraisers or assessors, so they do value the assessor’s opinion and will side with them if you cannot make a solid case. Use comparables as noted earlier, get a realtor’s opinion, and even better if you want to pay for it, get a professional appraisal and present it for their consideration.

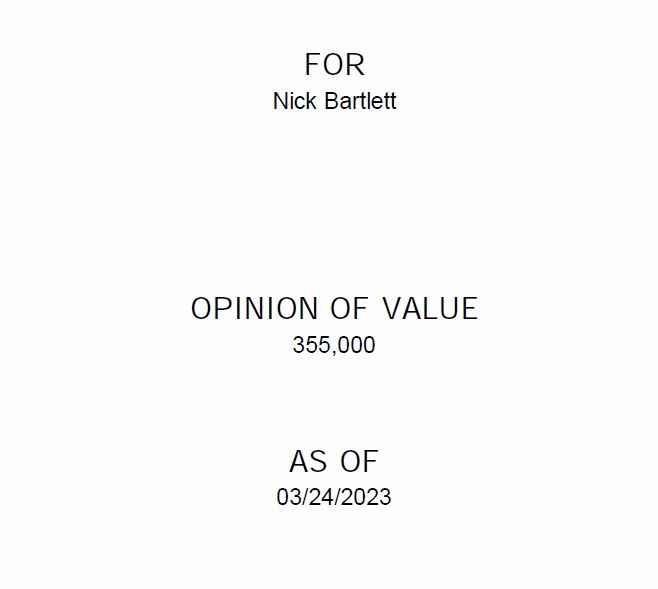

I ordered a “desk appraisal” of the property which literally means the appraiser didn’t leave their desk to create it. They can get pretty close and save a lot of time, so the cost was only $150 instead of $650. The desk appraisal came in right where I knew it would at $355,000.

The city council meeting I attended was a packed house and about 25 people spoke before me. Most of them were just angry as we’re in an affordability crisis with inflation and all, and didn’t have any substantial evidence or ask of the council. After 4 hours around 10pm, I had my opportunity to discuss my case for about 8 to 10 minutes. I was the only person to bring an appraisal, and it was considered and helpful. I was also the only person there with an investment property to discuss; everybody else was a homeowner. One of the assessors asked me about expenses so he could produce an income base valuation on the fly, but I didn’t have all the property expenses available. In any case, income based valuations are generally for apartments of 4 units or more, and we’d also need to know the rents of comparables, which we didn’t. This just added confusion to the city council, so they really didn’t know what to do. I reiterated a sales comparable approach is best for this property and how the appraisal came in at 355K.

I actually found a great comparable sale that the assessor didn’t consider – the duplex right next door to mine sold during the dates the assessor was considering. It sold for $400,000 and is the same size and structure as mine; it was built by the same builder at the same time. Also, while my assessment was $442,000, theirs was $407,000 for the same year. Here’s the next issue – my duplex has 2 bedrooms each side and unfinished basements, while this comparable has 4 bedrooms each side with finished basements. I argued to the city council the cost of finishing these basements is 60-80K, so that’s how much less my assessment should be.

In the end, I was one of two people to get their assessment reduced, but mine went from 423K to 407K as the council decided to have my assessment match the neighboring comparable. It still doesn’t make sense that mine would match. I let them know I appreciated the reduction and was still unsatisfied and would go to the county’s council meeting to discuss as the next step in the process.

After about 9 hours of time on this issue in talking to the assessor, showing the home, getting an independent appraisal, and attending the city council meeting for 5.5 hours, I reduced the assessed value from 442K to 407K. It’ll result in a tax savings of probably $300, but keep in mind I spent $150 to get the appraisal.

To be honest, like most people that don’t appeal their valuations, I’m at a point of thinking it’s not worth going any further. I could spend another 5.5 hours at the next meeting and get another slight reduction that’ll save me another $150. It’s just not worth the time.